Price Pressure Builds Again

Upward pressure on home prices is based on one basic dynamic: more demand than there is supply to satisfy it. Various factors can supercharge demand, such as extremely high rents and low interest rates, which make homeownership more attractive, as well as a sudden, large influx of new, affluent buyers (our high-tech boom) piling into what is basically a relatively small, inventory-constrained market. When there are 5, 10 or sometimes 20 qualified buyers chasing after every attractive, reasonably priced, new listing, prices typically go up, sometimes quite quickly. Last year, after the spring feeding frenzy, the market generally stabilized through the end of the year: It continued to be a strong market by any measure, but prices mostly plateaued, albeit often at new peak levels. We recently speculated on tentative signs that suggested a further market normalization, but now the indicators are pointing in a different direction. The inventory of homes available to purchase on any given day is even lower than before last year's furious market; buyer demand has emerged from its midwinter hibernation like a hungry bear; and prices are under increasing pressure once again.

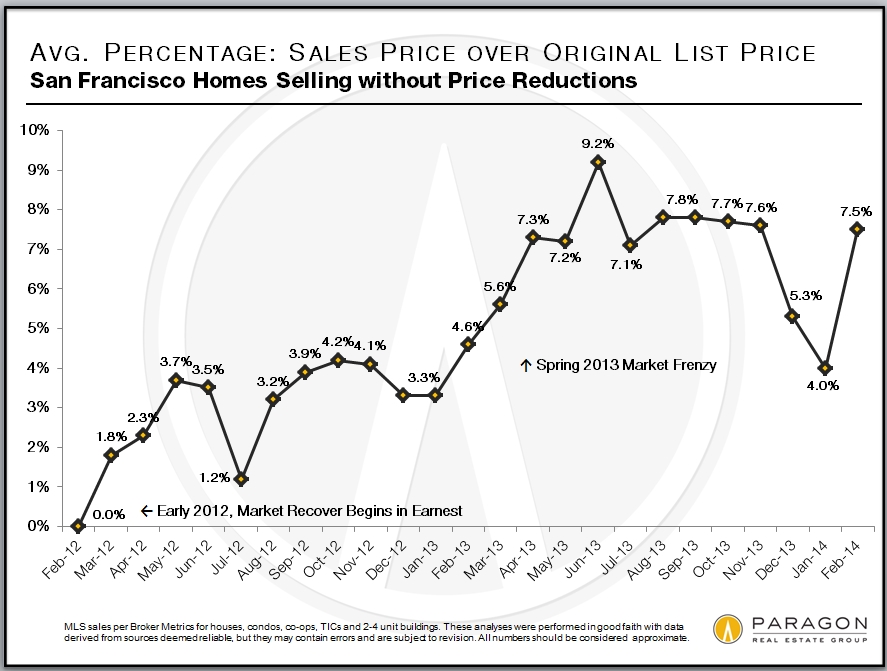

The spring selling seasons of 2012 and 2013 saw huge spikes in home price appreciation. Now we enter the third spring since our market recovery began in earnest, and the desire to live in our small, beautiful, expensive city continues unabated. We shall see how it plays out in the coming months.

Median Sales Prices: Heading Up Again

There is an aspect of seasonality to median home prices - typically up in spring, down in summer, up in autumn, down during the holidays -- which explains some of the fluctuations seen on this chart, though the upward trend since 2012 began is very clear. It's common for median prices to fall in January and February: This reflects offers accepted during the holiday season, when the higher end of the market often checks out. But not in 2014: median sales prices for houses and especially condos jumped dramatically in the past two months, which may suggest another white-hot spring market. Note that median sales prices are often affected by other factors besides changes in values, such as inventory, and longer term trends are much more meaningful than short term fluctuations.

Sales Price over Asking Price: A Sudden Spike

Last month, we pointed to the decline in the percentage of sales price over list price for homes selling without price reductions in December and January as a possible indication of a cooling market. February completely reversed that trend (though one should never make too much of one month's data).

Note that home sales follow the market, when offers are actually negotiated and accepted, by 30 to 45 days, so we are always looking at the market in the rearview mirror. Please call or email if you have any questions or comments regarding these analyses.

Statistics are generalities that sometimes fluctuate without great meaningfulness and may be affected by a variety of seasonal, inventory and economic factors. How they apply to any particular property is unknown without a specific comparative market analysis. All data from sources deemed reliable, but may contain errors and is subject to revision.

© 2014 Paragon Real Estate Group

Contact me anytime for assistance, information and resources regarding living in San Francisco.