March 2020 Market Report

There is a lot going on in the world right now and we won’t pretend to know how things will turn out or affect the local real estate market over the next few months. In the meantime, this report will look at the most recent data available, though the impact of the wild volatility in the financial markets and the unfolding situation with the coronavirus has yet to show up in reliable statistics. Typically, the spring selling season is the most active of the year, but with all that’s going on in the world right now, much remains to be seen.

One positive for real estate is that mortgage interest rates hit a historic low in early March, as illustrated below, and rates play a huge role in housing affordability. When the Fed dropped rates last week, the 10-year Treasury note hit around 0.47% — a third of the rate a year ago. In short, this means money is cheap, and it’s a great time to lock in rates if you want to buy or refinance. Contact me, and I’ll put you in touch with my colleague Monica di Perna at RPM Mortgage, whom I refer most of my clients to, and who handles my own financing.

Between that and continued market volatility from concerns over coronavirus and oil tensions between the Russians and Saudis, my bet is that we are shifting more into a buyer’s market. Last fall was already a bit soft, and these factors may continue to exacerbate this trend.

As always, please don’t hesitate to let me know if I can be of assistance in any way. I wish you and yours safety and health in these challenging days.

Mortgage Interest Rates Hit New All-Time Low

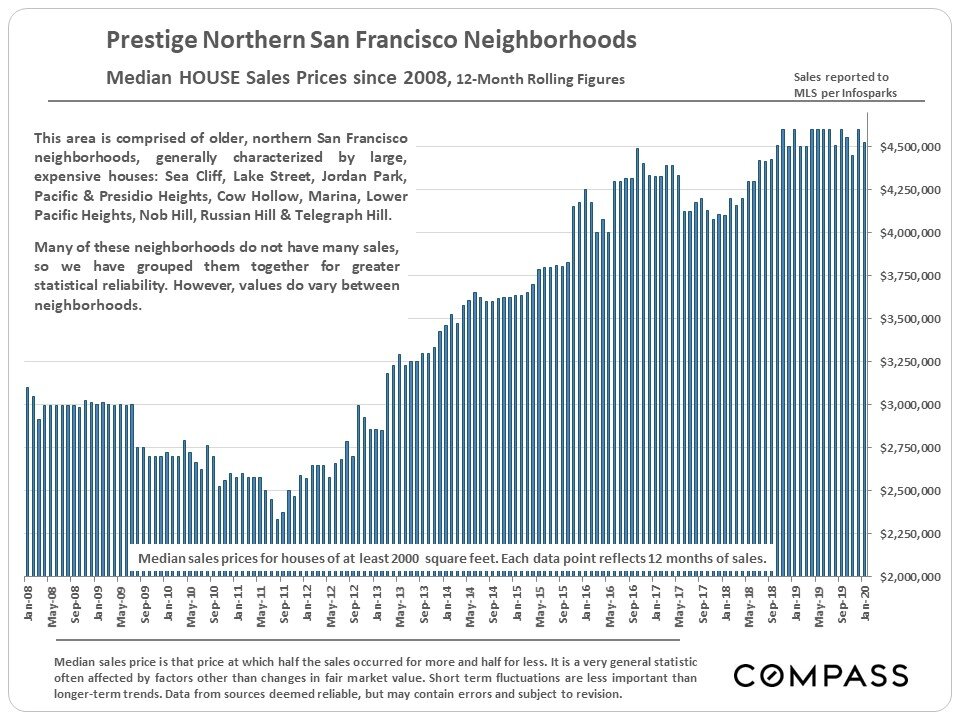

Short-Term & Long-Term Trends in Median Home Sales Prices

Median Dollar per Square Foot Values

Home Sales Breakdown

Listing Inventory vs. Sales since 2005

As noted in the chart, when the number of on-market listings and sales volume diverge, it indicates a cooling market.

Trends in Overbidding Asking Price

Overbidding remains common and at high levels for house listings in particular, however part of this is due strategic under-pricing on the part of listing agents. The supply and demand dynamic for condos has been affected over the last few years by new-condo inventory coming on market.

The Extreme Seasonality of Real Estate Markets

After the mid-winter doldrums, we would typically start seeing a huge jump in sales as the spring market gets underway. That said, again, if market jitters keep buyers at bay, there may be opportunity as motivated sellers reduce price or offer other incentives. Remember that sales are about a month behind the market, i.e. sales in one month mostly reflect new listings and offers accepted in the previous month.

Home Sales & Values by San Francisco District

Note that when we refer to neighborhoods, we use the SFAR map. Some people may perceive the cultural boundaries of a given neighborhood to be different than outlined in this map.

District Home Price Trends

There are 70+ neighborhoods in ten Realtor districts in San Francisco - too many to cover in one report. Below are some representative snapshots, but we also have trend data on every neighborhood in the city, which I’m happy to pull upon request.