The 2012 Rebound

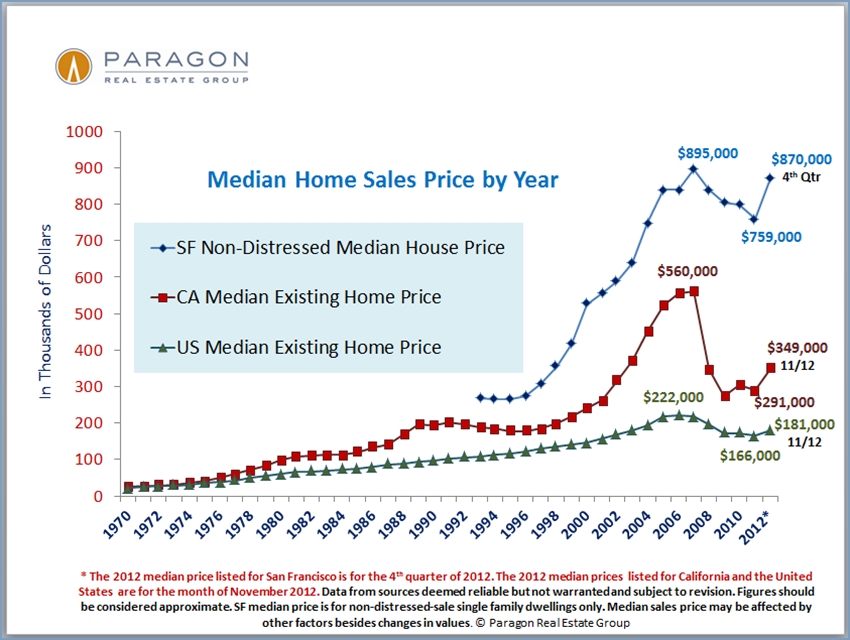

Exactly a year ago there were suggestions, based upon the changing market and economic dynamics we perceived developing in 2011, the SF real estate market was on the cusp of a major turnaround in 2012, possibly similar to what occurred in 1996 when the market blasted off after years of doldrums. And that is what happened, not only for the city, which led the way early in the year, but for the Bay Area, state and country somewhat later. Note that the SF house median price quoted here for 2012 is for 4th quarter non-distressed sales only.

Year over Year Changes in Values

Very generally speaking, and depending on neighborhood and property type, SF home values have risen by 10% to 20% over the past year. Here are two charts assessing the surprisingly consistent change in overall SF condo and SFD value statistics.

Sales by Property Type

Gradually, with the addition of the big new developments in the SoMa-South Beach district (and other areas of the city), condos have become the largest single category of property type sales in the city. This trend will only accelerate with the new burst in construction plans. And this link leads to a chart showing the resurgence in unit sales. Unit sales would have been much higher in 2012 if inventory had not been so drastically low.

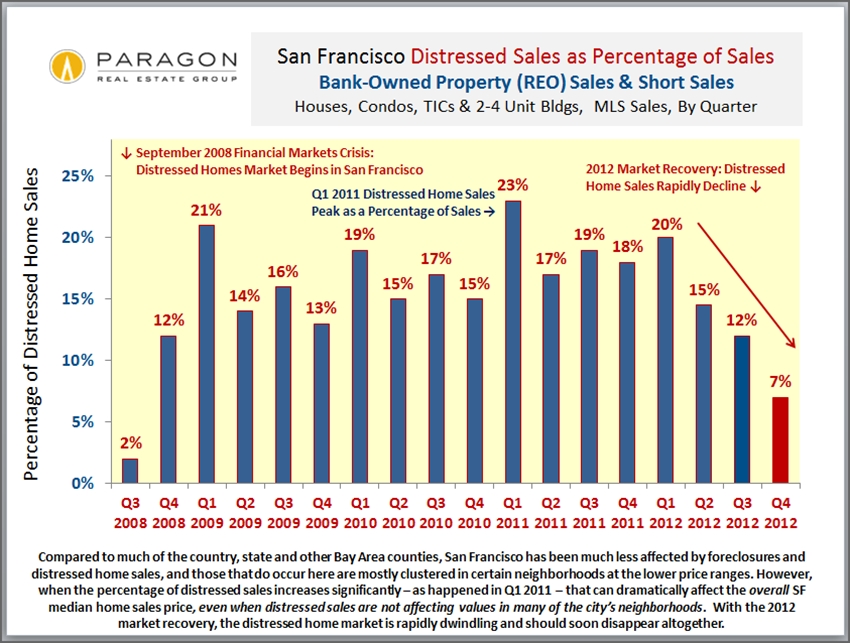

Distressed Sales: Goodbye to All That

Distressed home sales have been a market aberration caused by the collapse in loan underwriting standards and the refinancing frenzy of the bubble years. Fair market value is defined as "the price a willing, able and reasonably knowledgeable buyer would pay to a seller not under distress." But bank and short sales radiate distress: underwater sellers, overwhelmed and unresponsive banks; often the physical condition of the homes themselves is distressed. Buyers demanded a huge discount to deal with them. In SF, this market segment was largely confined to the lower price ranges and less affluent neighborhoods. Now, with the market recovery, the city's distressed home market is rapidly dwindling and should soon disappear altogether.