The South of Market (SoMa) & Mission Bay Condo Market

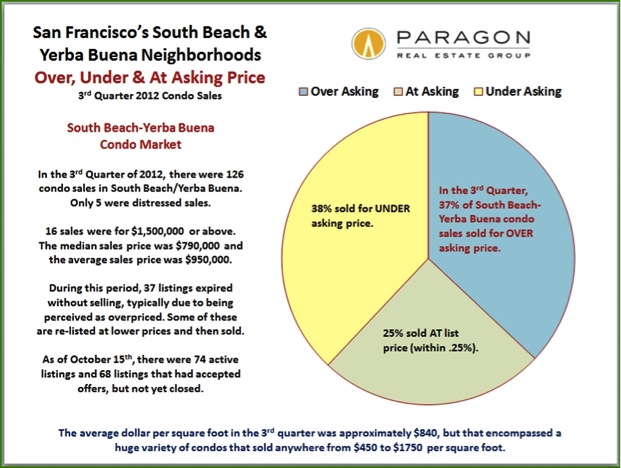

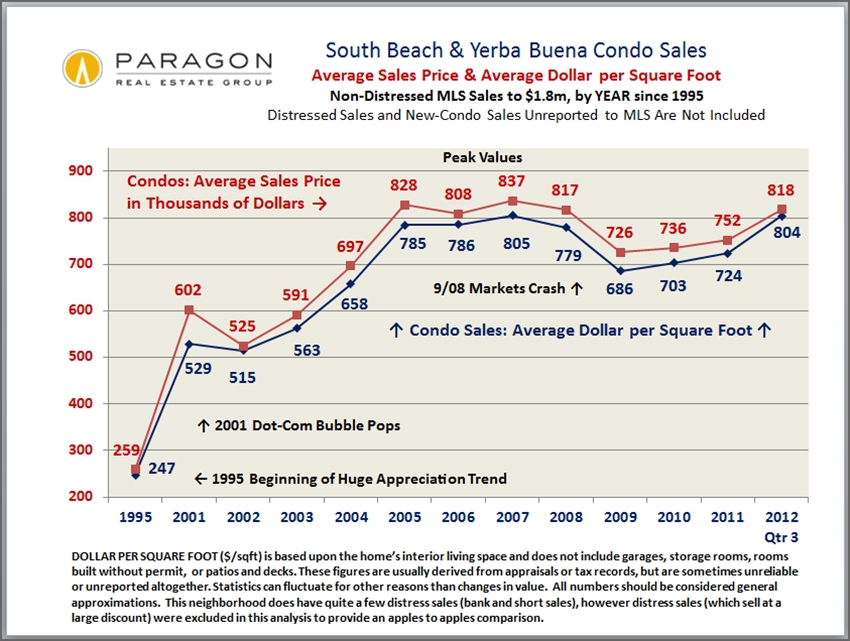

More condos sell in the South of Market (SoMa)-South Beach-Yerba Buena-Mission Bay neighborhoods than anyplace else in the city. This is where by far the greatest number of new condos has been built since the 1990's. The market here has been heating up very rapidly in 2012, especially as the number of brand new condos on the market has been rapidly declining. This is also one of the areas where high-tech buyers are concentrating in the city, and prices have been dramatically increasing. Luxury condos here, in high prestige buildings and typically with utterly spectacular views, sell for among the highest dollar per square foot values in the entire city.

Let me know if you have any questions about condo's in SOMA!

Let me know if you have any questions about condo's in SOMA!

***********************************

MEDIAN SALES PRICE is that price at which half the sales occur for more and half for less. It can be, and often is, affected by other factors besides changes in market values, such as short-term or seasonal changes in inventory or buying trends. Though often quoted in the media as such, the median sales price is NOT like the price for a share of stock, i.e. a definitive reflection of value and changesin value, and monthly fluctuations are generally meaningless. If market values are truly changing, the median price will consistently rise or sink over a longer term than just 2 or 3 months, and also be supported by other supply and demand statistical trends.AVERAGE SALES PRICE is calculated by adding up all the sales prices and dividing by the number of sales. It is different from median sales price, but like medians, averages can be affected by other factors besides changes in value. For example, averages may be distorted by a few sales that are abnormally high or low, especially when the number of sales is low.

DOLLAR PER SQUARE FOOT ($/sqft) is based upon the home's interior living space and does not include garages, unfinished attics and basements, rooms built without permit, lot size, or patios and decks -- though all these can still add value to a home. These figures are usually derived from appraisals or tax records, but are sometimes unreliable or unreported altogether. All things being equal, a house will sell for a higher dollar per square foot than a condo (due to land value), a condo higher than a TIC (quality of title), and a TIC higher than a multi-unit building (quality of use). Everything being equal, a smaller home will sell for a higher $/sqft than a larger one. (However, things are rarely equal in real estate.) There are often surprisingly wide variations of value within neighborhoods and averages may be distorted by one or two sales substantially higher or lower than the norm, especially when the total number of sales is small. Location, condition, amenities, parking, views, lot size & outdoor space all affect $/sqft home values. Typically, the highest dollar per square foot figures in San Francisco are achieved by penthouse condos with utterly spectacular views in prestige buildings.

Median and average statistics are generalities subject to fluctuation due to a variety of reasons (besides changes in value): how they apply to any specific property is unknown. Averages may be distorted by sales substantially higher or lower than the norm, especially when sample size is small. The only way to value a particular property is by performing a specific comparative market analysis based on its location, quality and amenities.

Sales not reported to MLS - such as many new-development condo sales -- are not included in this analysis (except in the specific chart on the SF new-development condo market). All figures should be considered approximate and are derived from sources deemed reliable, but may contain errors and omissions, and are subject to revision.